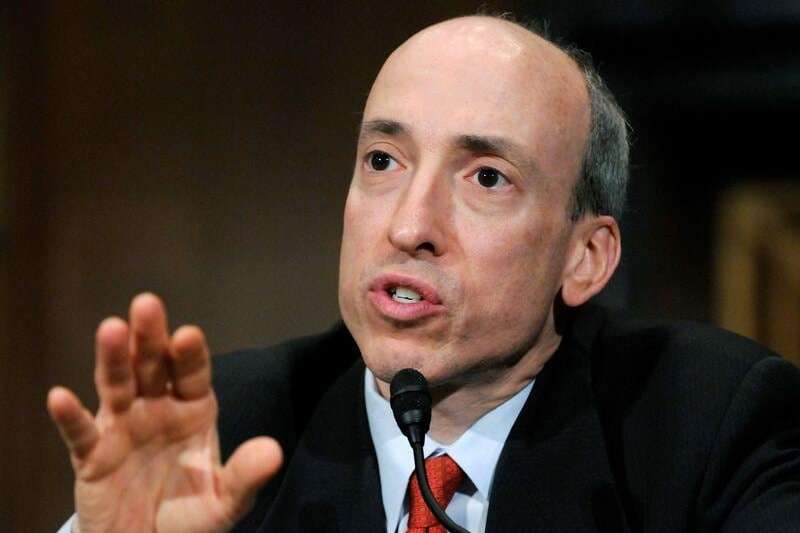

Last Friday (May 7), Gary Gensler, the recently appointed Chair of the U.S. Securities and Exchange Commission (SEC), talked during an interview with CNBC about the need for “greater investor protection” in the crypto markets.

According to a press release by the U.S. SEC, Gensler was “nominated to Chair the SEC by President Joseph R. Biden on February 3, 2021 and confirmed by the U.S. Senate on April 14, 2021.” He was sworn into office on April 17.

Before he joined the SEC, Gensler was “most recently Professor of the Practice of Global Economics and Management at the MIT Sloan School of Management, Co-Director of MIT’s Fintech@CSAIL, and Senior Advisor to the MIT Media Lab Digital Currency Initiative.”

His comments about the future of regulation of the crypto space came during an interview on CNBC’s “Squawk Box”.

Gensler said:

“I think to the extent something is a security the SEC has a lot of authority and a lot of crypto tokens — I won’t call them cryptocurrencies for this moment — are indeed securities. The prior Chair indicated that. The prior SEC brought numerous enforcement actions to sort of bring some of those security or investment contract tokens into the rules, but there are some like Bitcoin.

“If I can just focus on that — and that’s about half of this two trillion dollar asset class right now — it’s a digital scarce store of value, but highly volatile, and there’s investors that want to trade that and trade that for its volatility, in some cases just for its lower correlation with other markets.

“I think that we need greater investor protection there, and we don’t have a federal regime overseeing the crypto exchanges. So if an investor wants to trade on that Bitcoin, understanding it’s highly volatile, highly speculative, but if they want to trade on that, we haven’t placed some investor protection, and that’s what I was saying. I think there is a gap in our system right now.“

He was then asked what if Congress does not introduce legislation to address this gap.

Gensler replied:

“I think that as it relates to Bitcoin — and I’m not speaking to all the other tokens right now — our sister agency, the commodity futures trading commission, has some limited anti-fraud and anti-manipulation authority. There’s no federal authority to actually bring a regime to the crypto exchanges… and I think that’s really something that will be working with Congress and if they see fit to try to bring some protection for people that want to invest in the speculative asset class.“

(Photo : firstpost)