Beijing-backed anti-mining activities continue to gather pace in the Middle Kingdom, with major players apparently exiting the market and trading platforms such as BitMart moving to block Mainland Chinese IP addresses – but some miners in the nation have not given up on the industry, and even sense a new opportunity.

Yesterday, IT Home reported, the crypto platform BitMart announced that “all [Mainland] Chinese mobile phone number, or related account registration information that indicates that users are located in China” would face “restricted” access to its platform, with transaction closure functions still operational.

However, new transactions cannot be initiated from the Mainland, while attempting to transfer assets from Mainland locations into its wallets would “result in failure.”

The media outlet added that BitMart, which has some 5 million users, is backed by one of China’s biggest blockchain investors, the Shanghai-based Fenbushi Capital.

Sina reported that WeChat accounts linked to the publicly listed mining provider Shenzhen Internet Online Cloud Computing have been suspended, while the company’s shares have also ceased trading after it failed to release its FY2020 financial report.

The media outlet added that it was having trouble establishing contact with the company through official channels, which appear irresponsive.

And per Time Weekly, so-called “joint mining” ventures have also been hit hard by the recent crackdown. These ventures are a twist on traditional cloud mining models, and let participants mine remotely by buying hashpower from third-party vendors, only charging fees when the initial cost of miners’ equipment purchases has been covered. These include the B.TOP service, operated by the mining pool BTC.TOP, while the same media outlet claimed at least three such “joint mining” ventures are known to have totally suspended activities.

Much of the Chinese mining community appears to have been blindsided by the latest crackdown. Some have hoped to relocate from highly coal-dependent regions such as the Inner Mongolian Autonomous Region (IMAR) to other parts of China where cleaner energy solutions such as hydropower are more abundant.

But there are suggestions miners are now all being tarred with the same brush, with one miner quoted as stating:

“Sichuan Province put forward a number of crypto-related regulatory policies on many occasions in the past, but the actual impact on the industry was not significant. This time is different.”

Sichuan is believed to have considerable surplus hydropower that miners said they thought “was more environmentally friendly,” as well as “more room for policy leeway.”

However, even Sichuan appears to be keen to keep miners away, so effective has Beijing’s messaging been on this issue in the past few weeks.

Regardless, Time Weekly said, “multiple” chat app groups connected to mining and equipment exchange are still up and running, with no shortage of new would-be miners on the lookout for new places to set up shop – and posting enquires about buying rigs.

An individual who began crypto mining two weeks ago told the media outlet:

“We are currently in a policy adjustment period. People who are mining don’t dare talk about it publicly, but I think that now is the best time to get into the industry. So many mining machines are changing hands, and [setup] prices are becoming more reasonable.”

There was a note of caution from one veteran miner, though, who stated that as “regulation has become stricter,” it was now the case that “mining is no longer suitable for novices.”

Elsewhere, the MXC crypto exchange last week announced that it was blocking “new user” access to “some of [its] services,” including margin trading and futures “from a few specified countries and regions.” MXC did not specify which areas would be affected.

The platform vowed, “to abide by evolving policies and regulations of each jurisdiction to create a safer environment and preserve our users’ well-being and assets.”

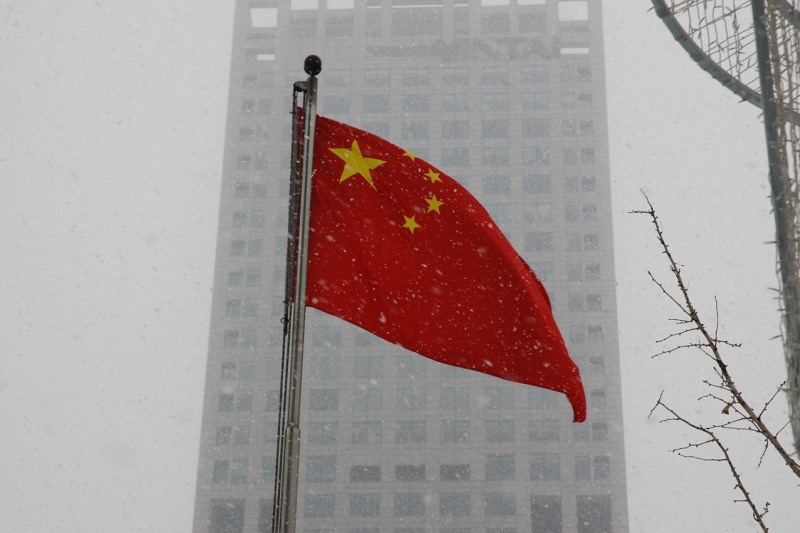

(Photo : Gallery)