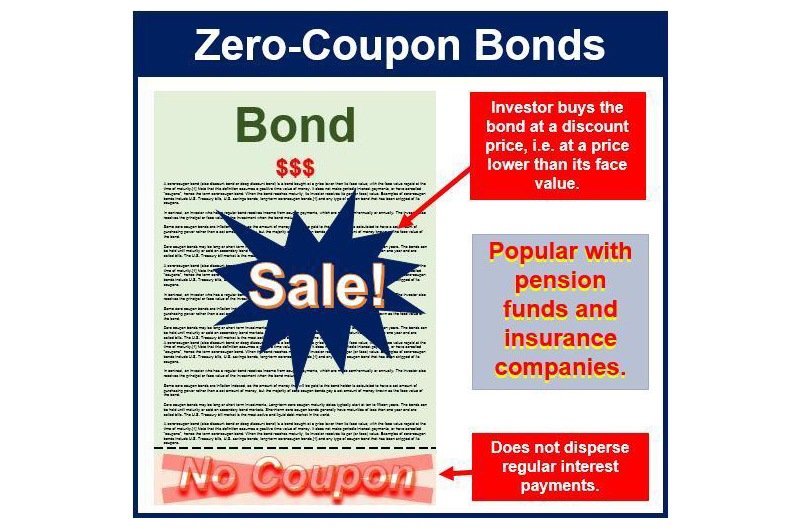

A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy.

A zero-coupon bond has no periodic interest payments – meaning that it pays no coupons and has a coupon rate of 0%. A bond’s coupon rate refers to how much is paid to the bondholder annually on its face value.

Examples include U.S. Treasury bills, U.S. savings bonds, and long-term zero-coupon bonds, i.e. any type of bond with no annual interest payout.

Zero-coupon bond is bought at a discount. When it matures the holder receives the principal amount or face value.

A long-term zero coupon bond usually has a maturity date that extends to at least ten years. A short-term zero coupon bond generally has a maturity date that extends to less than 12 months (known as ‘bills’).

Long maturity zero-coupon bonds are often bought by pension funds and insurance companies because of their high duration – they help immunize the firms’ interest rate risk of long-term liabilities.

As zero coupon bonds pay no interest until maturity, their prices tend to fluctuate more than other types of bonds in the secondary market.

Investors may also be subject to paying federal, state, and local income tax on the imputed or “phantom” interest that accrues each year. It also allows an investor to only allocate a small amount of money that has the potential to grow over many years.

According to the U.S. Securities and Exchange Commission, zero-coupon bonds:

“Are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount a bond will be worth when it “matures” or comes due. When a zero coupon bond matures, the investor will receive one lump sum equal to the initial investment plus the imputed interest, which is discussed below.”

Video – Zero-coupon bonds