A Zero-Cost Option is a strategy where one option is purchased by simultaneously selling another option of the same value. It is an option trading strategy in which one could take a free options position for speculating or hedging in Forex, commodity or equity markets. It is also known as Risk Reversal Strategy or Zero Cost Hedge.

With a zero-cost option, the net cost is zero. It is a combination of option buying and option writing. The price of the premium (written option) is equal to the premium (price) paid for the option that is purchased.

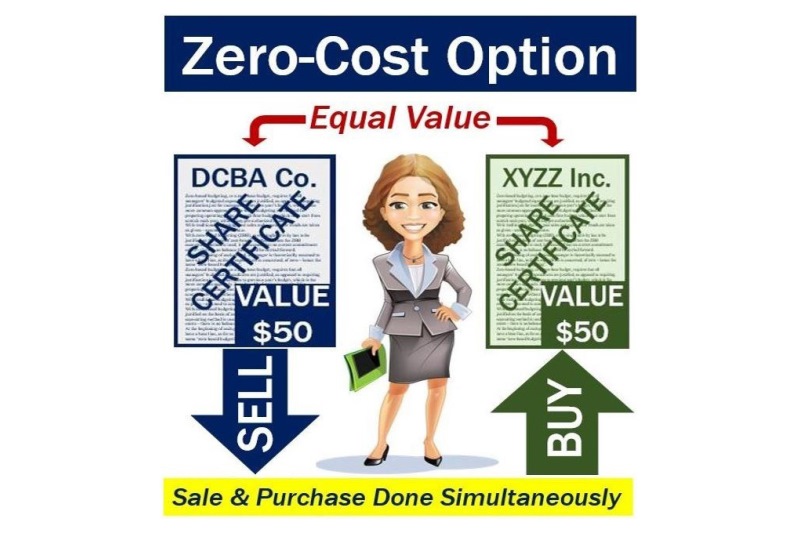

Put simply, a zero-cost option involves the simultaneous sale and purchase of two assets so that both costs cancel each other out exactly.

According to BusinessDictionary.com, zero-cost option is:

“Trading strategy in one option is purchased and simultaneously a matching option of the same value is sold.”

A zero-cost option strategy is one where something is bought while something else – with the same value – is sold at the same time.

Building a zero-cost option position

This strategy can be constructed in two ways, depending on whether you are feeling bullish or bearish.

According to ValueStockGuide.com:

– If you are Bullish in a particular stock: “Buy out-of-the money call option and simultaneously sell out-of-the money put option in same stock for that month.”

– If you are Bearish in a particular stock: “Buy out-of-the money put option and simultaneously sell out-of-the money call option in same stock for that month.”

While building the two strategies, we generally use the sale of one out-of-the-money put or call option to finance the buying of counter options, which makes this a zero-cost option.

In these positions, the investor might earn unlimited profit, but also runs an equal risk of unlimited losses.

A Zero-Cost Strategy is one that costs nothing to execute. For example, if I am selling my house, I might decide to clear out clutter from the garage and generally tidy up the inside of the house. This costs me no money, but is a strategy that may help in the successful sale of the property.