A survey of 30 central banks brought somewhat surprising results as some bankers showed signs of openness to cryptoassets such as bitcoin (BTC). Also, central bankers are becoming more concerned about inflation.

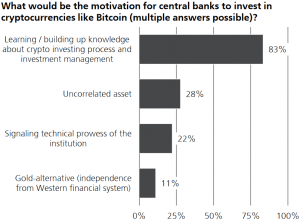

First, 14% of the respondents said that central bank digital currencies (CBDCs) would increase pressure on these banks to invest in crypto, while 83% of the participants replied that the learning process of investing and managing this new asset class itself could be valuable for the institution they represent, according to this year’s annual survey of unspecified central bankers by Swiss investment bank UBS.

“28% of participants see benefits coming from cryptocurrencies as an uncorrelated asset, and a further 11% would consider it as an alternative to gold,” the report added.

Moreover, 46% of respondents said that, in their opinion, bitcoin and other cryptoassets will not be displaced by CBDCs, while 33% presented the opposite view, and 21% had no opinion on this.

In either case, about 40% of surveyed central banks expect a wholesale CBDC to be launched within the coming three years. Some 46% of the participants confirmed their central bank was already involved in CBDC pilot projects, or was expected to do so in the next 1 to 3 years.

The majority of participants declare they “are not yet able to make predictions if reserves will be invested in CBDCs issued by other central banks in the foreseeable future,” UBS said, adding that “57% of participants see no meaningful impact for the reserve management at their institution, while 24% indicate that there might be an impact on their back-office operations.”

Also, per the survey, more than 60% of respondents do not believe that the launch of CBDC will lead to a diminished role of the USD and more than 50% do not know yet what will be the impact of a digital yuan on the internationalization of the Chinese currency.

(Photo : FXStreet)