Social investing platform eToro has just announced the acquisition of Delta – a portfolio tracker app that provides a dynamic picture of the crypto market, including prices, market charts, and an alert system to allow users to stay ahead of the curve with investment opportunities.

While the purchase amount was not disclosed, industry experts told TechCrunch the takeover deal was worth $5 million.

eToro co-founder and CEO Yoni Assia said that the move is aimed to accelerate the growth of their crypto products with the acquisition of Delta to add “an important new element.”

Describing eToro’s expansion so far as largely organic, Assia said his firm is seeking to acquire businesses that can complement the offering as a whole.

“We are a trading and investing platform that not only provides clients with access to the assets they want, from commission free stocks and ETFs through to FX, commodities and cryptoassets, but also lets customers choose how they invest. They can trade directly, copy another trader or invest in a portfolio,” he explained.

“At a time when other fintechs state that they are not even targeting profitability, we are proud to be a well-funded, profitable business that is growing both in terms of geographical coverage but also product range,” added Yoni Assia.

More about Delta app

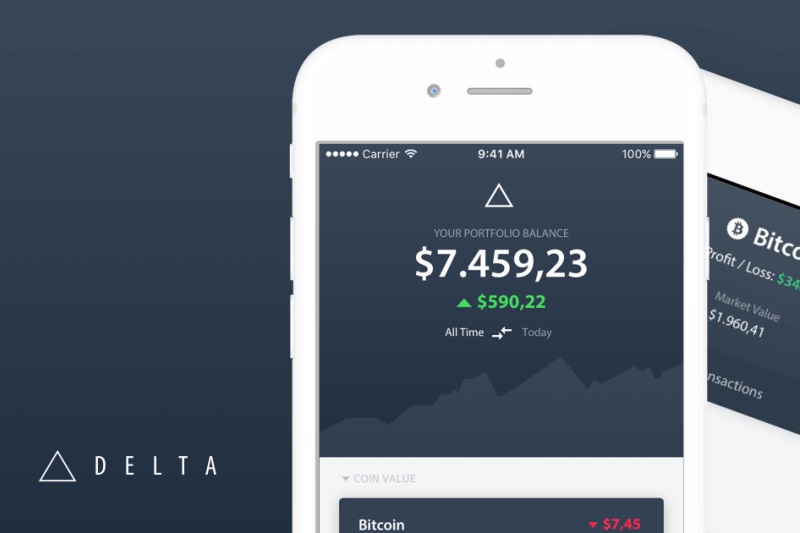

Launched in 2017, the Delta crypto app first burst onto the scene to cater to investors needing a better crypto portfolio tracker. The startup branded itself as a tracker application that offers more than 6,000 crypto assets that are available from more than 180 exchanges around the world. Delta also makes money from offering a paid subscription for additional premium features.

The newly-acquired startup will work independently within eToroX, the cryptocurrency arm of the UK-based social trading network. The co-founder and CEO of Delta, Nicolas Van Hoorde, emphasized the seamless integration and confirmed their team would continue to work based out of Belgium.

Created last year, eToroX is tasked with defining and executing eToro’s vision around blockchain, including its upcoming crypto exchange, and the development of crypto assets. Last year, the company unveiled its own proprietary cryptocurrency wallet. The company also has recently secured Gibraltar’s financial services watchdog’s bespoke license for blockchain firms using distributed ledger technology.

The acquisition news comes soon after eToro launched its flagship product, CopyTrader™, for crypto traders in the US The firm said that the platform is now available to American customers from 32 states with plans to expand elsewhere in the US after receiving the necessary regulatory sign-offs.