Binance.US, the American outpost of the world’s biggest crypto exchange, just announced it would be making its services available to Alabama residents. This marks the exchange’s latest expansion into the US and makes Alabama the 39th eligible state to use Binance.US platform. It also comes nearly three weeks after it opened for business in Florida.

Alabama was one of the 13 states not included in Binance.US’s original launch in the US. While its services debuted in 37 states in September 2019, the influential crypto venue avoided states whose regulation required additional licenses. Taking out the Sunshine State and Alabama, the list of states that are still out of bounds for Binance.US. now includes Alaska, Connecticut, Georgia, Hawaii, Idaho, Louisiana, New York, North Carolina, Texas, Vermont and Washington.

Once the registration process starts, Binance.US will begin accepting inbound transfers in supported coins, allowing new users to move USD into over 40 different cryptocurrencies instantly upon appropriate account verification. The exchange stated it expects more cryptocurrencies to be added in the coming weeks provided that they pass Binance.US’s Digital Asset Risk Assessment Framework.

Binance.US Complements Offering with OTC Trading

Binance originally entered the US market in late 2019 via a partnership with BAM Trading Services, a FinCEN-registered company, to roll out the new platform exclusively for customers based in the United States. Binance has licensed its matching engine and wallet technologies to its US partner, which handles operations in compliance according to local regulations.

At the time, the crypto venue appointed Catherine Coley, the former head of XRP Institutional Liquidity, to join the fledgling US exchange as CEO.

Most recently, Binance.US has added an over-the-counter (OTC) trading portal, which allows the execution of transactions on a large variety of crypto and fiat pairs.

The OTC desk, which facilitates dealing between trade parties directly, instead of relying on the supervision of an exchange, joins similar services at other top US crypto businesses.

Coinbase, Poloniex, Gemini, and Circle started their over-the-counter trading operations earlier last year. The OTC business complements those exchanges’ underlying services as many institutions were already using OTC as a proxy for crypto trading.

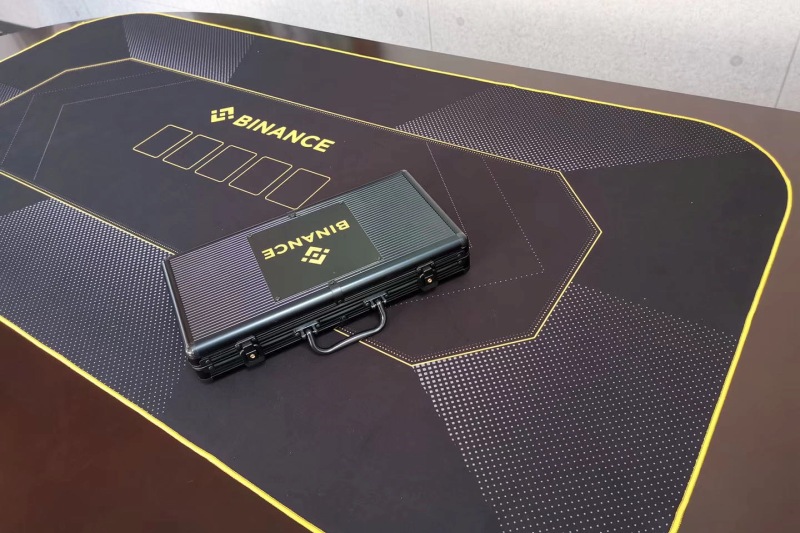

(Photo: Binance)