Basis Cash launch defunct stable coin into the DeFi age. Basis Cash is based on the stablecoin basis (originally known as Basecoin) that had $133 million in funding before the U.S. securities regulators jumped in and the team behind it returned it in late 2018.

For those who want to get involved in this new Decentralized Finance (DeFi) initiative, smart contracts opened early on Monday. As an example, this is not the first base-inspired stablecoin to be released. Empty Set was released at the end of August and now has over $100 million in market capitalization.

“In the long term, we look forward to seeing Basis Cash be used widely as a base layer primitive such that there is organic demand for the asset in many DeFi and commercial settings,” one of the two anonymous leaders of the project who goes by “Rick Sanchez” said.

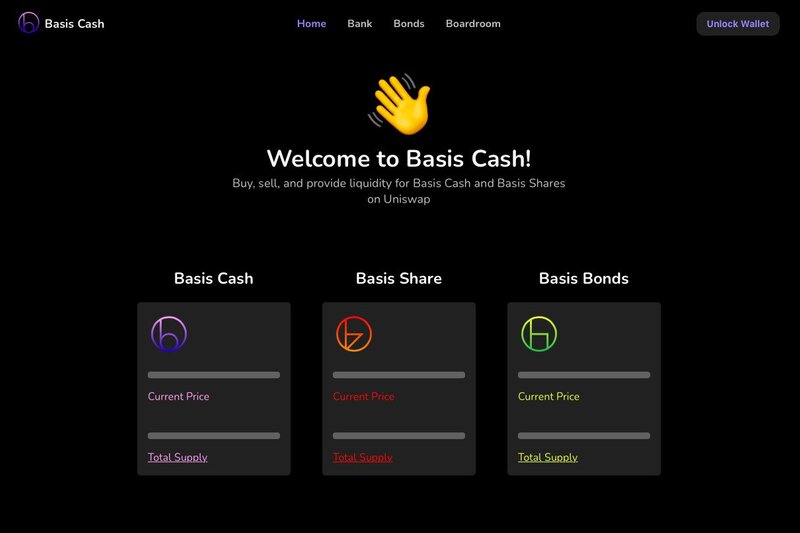

Like most stablecoins, Basis Cash (BAC) is pegged to the U.S. dollar, so one BAC should be equal to the crypto equivalent of one USD. Basis Cash’s price will be managed by two other crypto assets: Basis Bonds and Basis Shares (more on what each does in the next section).

Starting at the end of November, 50,000 BACs will be allocated over a five-day period (10,000 per day to people who put any of these five stablecoins in their smart contract: DAI, YCRV, USDT, SUSD and USDC. Depositors can’t lose more than 20,000 stablecoins from any single account. The daily incentive will be paid on a pro-rata basis and users can get their coins back out at any time.

Unlike most other DeFi projects that do some form of liquidity mining like this, that pool of four stablecoins won’t be doing anything. Depositors will be liquidity providers into still waters. “It’s admittedly a useless capital exercise,” Sanchez wrote. “Think of it as kind of like a Coinbase Earn quiz. Minimum threshold to get free assets.”

The main takeaway with Basis Cash is that it’s absolutely undefeated to anything with a “real value”. Basis Cash has nothing locked away to guarantee its worth. Its only guarantee is a purely algorithmic method that should help to find real market demand for BAC such that its price appears to be equal to $1.

So, if BAC should drop below a dollar, the system will issue Basis Bonds. Those Basis Bonds can be bought for one BAC. They can also be redeemed for one new BAC when the price is above a dollar.

Leader of the team that launched the original Basis, Nader Al-Naji wrote “A lot of people have reached out to me about Basis Cash. It seems to be gaining traction among the people who backed me with Basis given how many people have asked me about it, but I don’t know anyone who’s definitively decided to back the project.”

[image: Basis Cash]