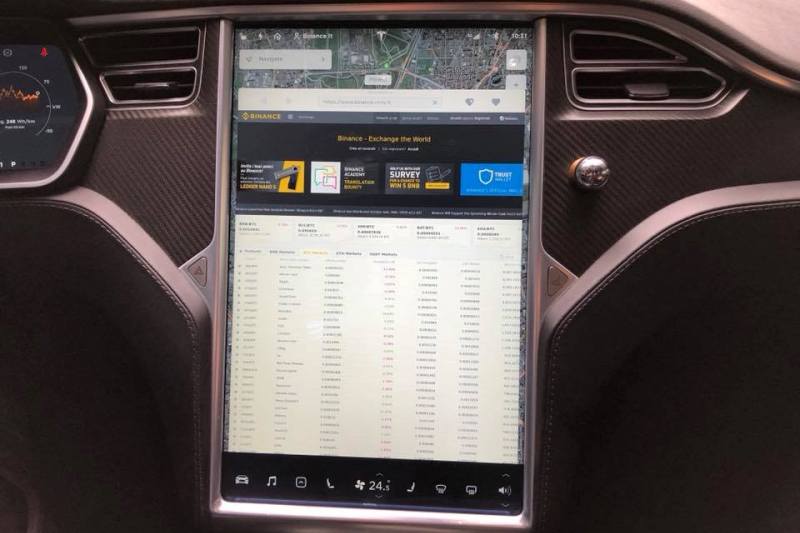

Binance is launching the test network (testnet) of its decentralized exchange, which is the first use case of its own blockchain “Binance Chain.” The Binance DEX went live today, and the exchange’s CEO says the public feedback will be much appreciated to further develop and refine the project.

“Binance DEX is a decentralized exchange with a decentralized network of nodes, where you hold your own private keys and manage your own wallet,” said Changpeng Zhao (CZ), CEO of Binance.

‘Binance Chain’ is based on an improved version of the emerging technology that focuses on performance, ease-of-use, and liquidity. It will be used to transfer and trade blockchain assets while eliminating administration tasks through smart contract rules and thus, speed transaction settlement.

Binance was the world’s most active crypto exchange over the past 24 hours, according to Coinmarketcap.com, hosting $1.37 billion worth of cryptocurrency trades.

The major crypto venue also upgraded its own token Binance Coin (BNB), which launched along with the exchange in 2017, to exist on its public blockchain. Binance’s crypto coin, which is an ERC20 token built on Ethereum, has benefited from the exchange’s explosive success and is now listed among the top 10 cryptocurrencies in the world by market cap.

Decentralized Leap

The improved version of Binance Coin (BNB) is expected to represent the motherboard that serves the entire Binance blockchain, as well as other features that are yet to come. Among other things, BNB is currently used to pay for exchange fees and allow participants to make investments within Binance ecosystem.

With an already existing user base of several million, the opportunities for this Blockchain and cryptocurrency seem enormous.

“With the core Binance Chain technology, Binance DEX can handle the same trading volume as Binance.com is handling today. This solves the issues many other decentralized exchanges face with speed and power,” notes CZ.

With the rising limitations of the centralized crypto exchanges, many old blockchain players are now developing decentralized platforms to cope up with the market competition. Major players have earlier launched native decentralized platforms and were joined by many market counterparts.

However, the picture is not always rosy. One example was the launch of Waves DEX earlier in July when hackers hijacked both the exchange website and the company’s main site to phish for users’ personal wallet information.

(Photo: Binance)