A Yankee bond is a foreign bond that is denominated in US dollars and issued in US territory. The Yankee bond, which is registered with the US Securities and Exchange Commission (SEC), is issued by a foreign bank, foreign company, or foreign government utility. Yankee bonds are the US equivalent of **Eurobonds.

** Eurobonds are bonds that are issued in a foreign currency. For example, a bond issued by an American company in Australia, in Australian dollars, is an example of a Eurobond..

In most cases, Yankee bonds are issued in tranches – individual parts of a larger debt offering. They may also be structured with differing levels of risk, maturities, or interest rates.

Yankee bond offerings are often huge, sometimes reaching values in excess of $1 billion.

According to Nasdaq’s Investing Glossary, Yankee bonds are:

“Foreign bonds denominated in U.S. dollars and issued in the United States by foreign banks and corporations. These bonds are usually registered with the SEC. Such as, bonds issued by originators with roots in Japan are called Samurai bonds.”

————————————————–

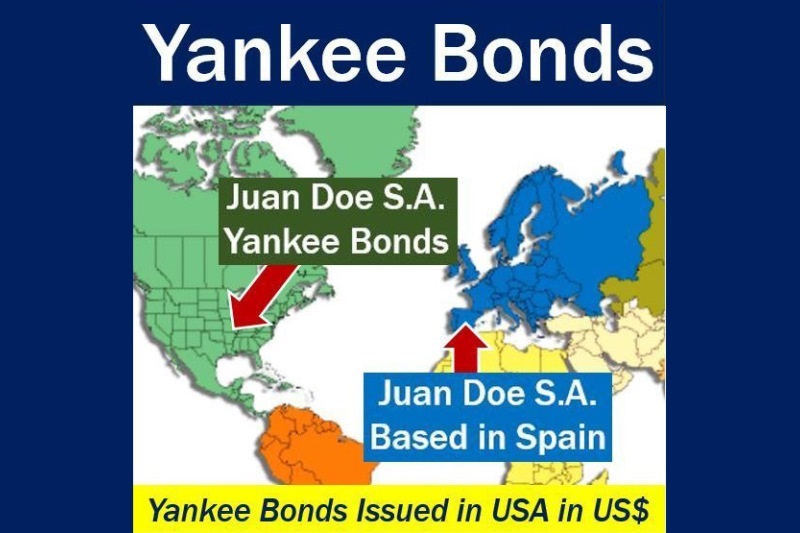

Juan Doe S.A., a company based in Spain, wants to raise funds from US investors in the USA. It applies to the SEC to issue Yankee bonds in the US. After three months, its application is approved, and Juan Doe Yankee bonds are issued. The bonds are denominated US dollars.

————————————————–

A bond is a loan, a kind of debt or IOU. The purchaser of a bond is lending money to a company, city, or government.

Yankee bond disadvantages

For the Yankee bond issuer, one of the main disadvantage is time. If you want to raise money in a hurry, Yankee bonds are not for you.

US rules and regulations for issuing such bonds are very strict – it can take several months before an issue is approved for sale.

The US regulator needs to evaluate the issuer’s credit worthiness, usually through Standard & Poor’s, Moody’s, or another reputable debt-rating agency.

Yankee bonds tend to be riskier investments compared to domestic US bonds. This is great if they do well, because their yields will exceed any other similar US debt instrument.

However, because many of them are deemed as risky as junk bonds, they could turn out to be a bad investment.

————————————————–

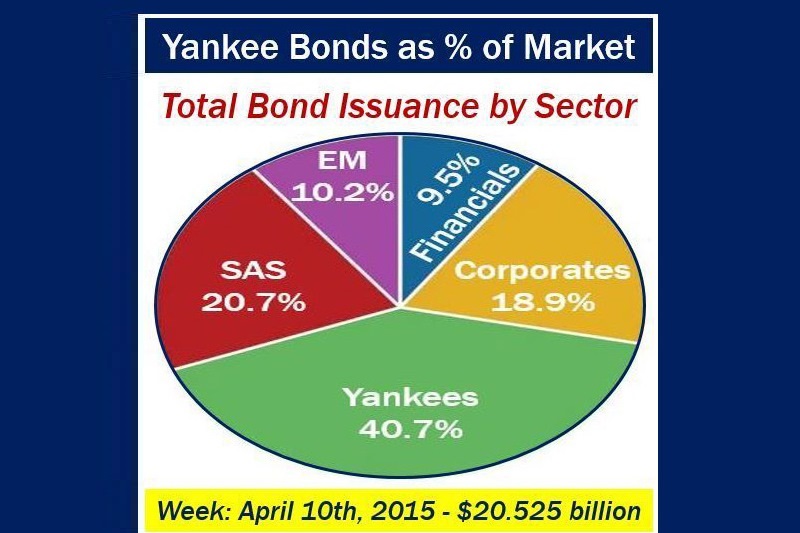

The Yankee bond represents the largest proportion of bonds issued in the United States. US investors clearly have a healthy appetite for global investment opportunities. Since the 2007/8 global financial crisis, the market for Yankee bonds has grown considerably. (Data Source: marketrealist.com)

————————————————–

Yankee bond issuers tend to prefer bonds with relatively low interest payments. Therefore, such debt instruments only sell well when US interest rate are very low.

After the 2007/8 global financial crisis, interest rates in the US and the other advanced economies were very low. Yankee bonds became extremely popular post-crisis as American bond investors’ hunger for higher yields grew.

In an article – ‘Yankee Bonds: higher risk, and return’ – published in BankRate.com in 2011, Claes Bell wrote:

“Yankee bonds’ recent popularity can be attributed in part to the hunger for higher yields among American bond investors, who have been starving on ultra-low domestic yields on Treasuries, and even on junk bonds, says Hildy Richelson, president of the Scarsdale Investment Group in Blue Bell, Pa.”

Yankee bonds – advantages

For the US investor, Yankee bonds provide an element of asset diversification. Much of their performance is not directly linked to how the US economy is doing.

As foreign economies often move in different directions and rhythms to the US economy, Yankee bond prices do not always move in parallel to US bonds. When the US economy is not doing particularly well, such bonds are appealing to investors.

————————————————–

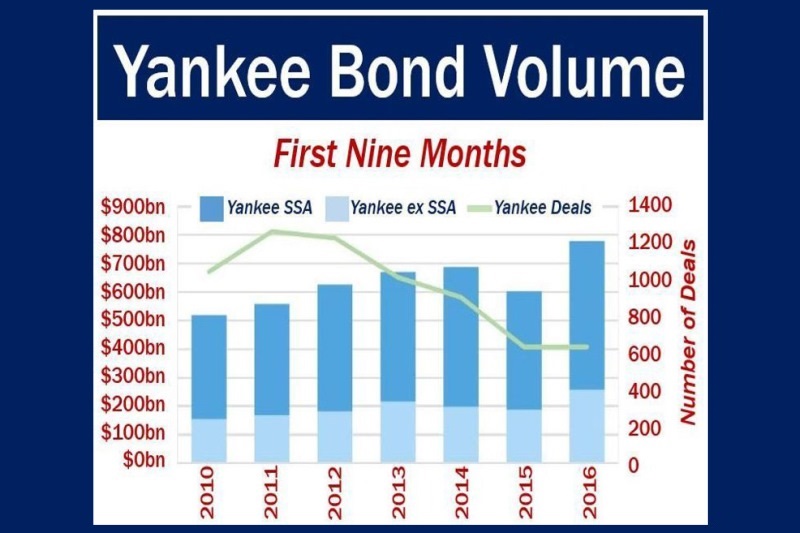

According to ScoopNest.com, Yankee bonds rose by 30% to a record high during the first nine months of 2016. (Image: adapted from ScoopNest.com)

————————————————–

The Yankee bond market provides US investors with the ability to capture some of the spectacular growth that occurs elsewhere in the world.

In the same BankRate.com article, Richelson said:

“You can tap into growing emerging market economies by buying bonds of companies that are represented in those countries.”

Yankee bonds also insulate the investor from currency risk. As they are issued in dollars, the US investor is not affected if the bond-country’s currency declines in value.

As Yankee bonds are issued in the United States and denominated in US dollars, just like American bonds, investing in them is fairly straightforward. They are shown on the bond-trading platforms that retail investors use.

If you are a risk-averse investor and don’t like the idea of placing a large amount of money into one corporate bond, you should consider investing in a Yankee bond-friendly fund. These types of funds purchase a range of bonds, including Yankee bonds.

Yankee market

The Yankee market is where foreign securities are bought and sold inside the United States.

Yankee bonds, for example, are traded in the Yankee market.

Video – What is a Yankee bond?

In this Video Definition video, the speaker explains what Yankee bonds are.