IRS to ask every American worker on their crypto usage in 2020. Any American filing taxes for 2020 would have to notify the IRS whether they used crypto this year, according to the tax agency’s latest report.

On Aug. 19, the IRS issued draft income tax forms for 2020 that would question any American filing income for the year if they used crypto or not.

Early into its very first page, the latest 1040 form asks “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Chandan Lodha, founder of crypto tax software firm Cointracker said “The cryptocurrency question is now front and center on the IRS Form 1040 for next year. Pretty clearly shows that the IRS is taking cryptocurrency taxes even more seriously.”

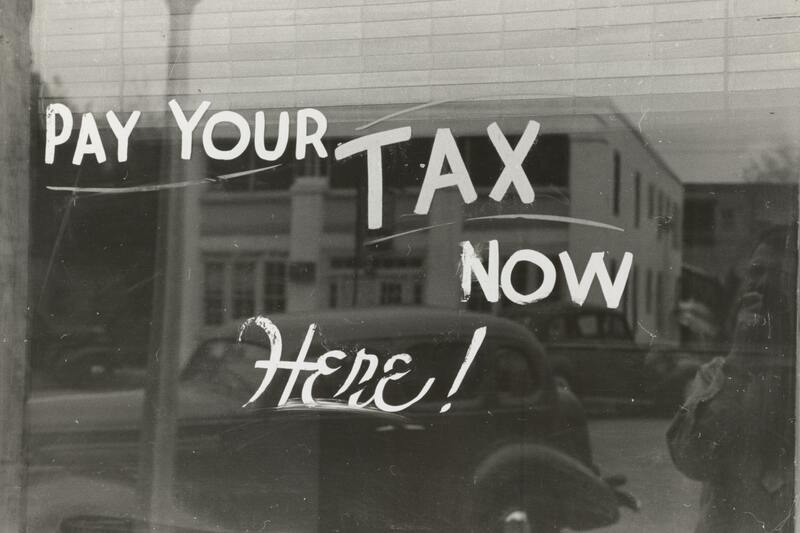

[image: The New York Public Library]